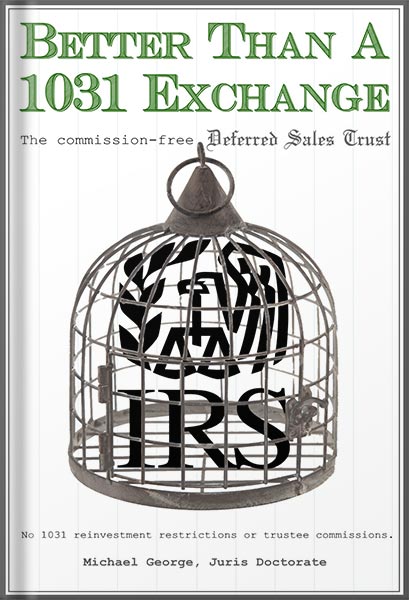

دانلود کتاب Better Than A 1031 Exchange | The Commission-Free Deferred Sales Trust: no 1031 reinvestment restrictions or Trustee commissions by Michael George Juris Doctorate

Will you be selling real estate, a business, or cryptos for a significant profit?

If so, this is the best capital gains tax deferral strategy you’ve never heard of.

THIS IS THE ONLY CURRENT EXISTING RESOURCEfor commission-free Deferred Sales Trust (DST).

DSTs save capital gains taxes by deferring them for your lifetime, allowing your DST trust to snowball a newfound compounding fortune.

DST are better than 1031 exchanges because they don’t have 45-day real estate only reinvestment restrictions. Your reinvestment shackles are off.

Check out my 2-Part Video Series at DSTkit.com – on the “in a nutshell” page.

A DST is your trust middleman that you transfer your property to. The DST sells it to the buyer. You get an installment note, with interest. Your DST retains and reinvests the sale proceeds – including the capital gains taxes – compounding an otherwise lost fortune over decades.

دانلود کتاب:

Better Than A 1031 Exchange | The Commission-Free Deferred Sales Trust: no 1031 reinvestment restrictions or Trustee commissions by Michael George Juris Doctorate PDF

نویسنده: Michael George Juris Doctorate

پیش نمایش کتاب

It’s easy to read. At just 77 pages, you can read it in an afternoon. And there’s no fluff. I get straight to brass tacks.

You’ll immediately “get” the entire DST strategy used by savvy investors in the know.

Your DST trust can strategically sit in cash, and reinvest in alternative investments to real estate.

Because finance professionals can’t make money selling commission-free DSTs they’re not marketed and little known.

That’s why you may have never heard of it.

All other investors going to DST corporate shops are paying 1.5% of the value of their entire trust every year in corporate trustees commissions! That’s paying real estate agent level commissions every year. Why? Because the corporate shops require you to use their expensive corporate trustees.

But you’re legally entitled to use your own appointed little-to-no cost trustee. This option isn’t made available through corporate DST firms. There’s no money in it for them.

Using your own appointed trustee saves a large fortune over the life of the DST trust, and saves an even larger fortune in opportunity cost from lost compounding.

If you appoint a a trusted friend or qualified family member (like an in-law) to serve as trustee just a few hours a year, your DST Trustee cost will be zero. Your trust can keep that expense for itself, compounding a tremendous additional fortune for your family.

You’ll learn the many ways that you, as grantor, can legally benefit from the DST trust – beyond just the installment note payments and interest on page 15.

You’ll know why DSTs can’t save tax on gains over $5 million and what to do to protect amounts above that threshold on page 18.

You will learn what to do to protect the capital gains your DST makes within the trust on page 19 (you can’t just leave it in the DST and defer the tax on trust investment gains).

You will know from Chapter 4 why DSTs are financially superior to other tax favored strategies like 1031 exchanges, Qualified Opportunity Zones, Solo 401(k)s, Delaware Statutory Trusts, and Charitable Remainder Trust . . . and so much more!

Listen. As much as the DST corporate trustee-for-hire crowd likes to complicate DSTs, they’re actually simple.

Here it is:

Step 1. Choose your options and sign the DST trust contract.

Step 2. Transfer the property to the DST in exchange for your installment note.

Step 3. The DST sells the property to the 3rd party buyer.

Step 4. The DST invests all sale proceeds including retained capital gains taxes as you’ve directed.

Step 5. The DST distributes installment payments to you and trust income and assets to your beneficiaries according to your prearranged DST instructions.

That’s it. You got this!

| نویسنده | Michael George Juris Doctorate |

|---|---|

| سال | 2024 |

| زبان | English |

| فرمت فایل | PDF + EPUB + AZW3 |

| تعداد صفحات | 92 |

دانلود کتاب Better Than A 1031 Exchange | The Commission-Free Deferred Sales Trust: no 1031 reinvestment restrictions or Trustee commissions by Michael George Juris Doctorate

178,000تومان

- خرید و دانلود آنی کتاب

| نویسنده | Michael George Juris Doctorate |

|---|---|

| سال | 2024 |

| زبان | English |

| فرمت فایل | PDF + EPUB + AZW3 |

| تعداد صفحات | 92 |

محصولات مرتبط

-

دانلود کتاب Not All Diamonds and Rosé: The Inside Story of The Real Housewives from the People Who Lived It by Dave Quinn

86,000تومان افزودن به سبد خرید -

دانلود کتاب Storytelling with Data: Let’s Practice! by Cole Nussbaumer Knaflic

95,000تومان افزودن به سبد خرید -

دانلود کتاب Mustang Sallies by Fawn Germer

95,000تومان افزودن به سبد خرید -

دانلود کتاب The Laws of Human Nature by Robert Greene

84,000تومان افزودن به سبد خرید

نقد و بررسیها

هیچ دیدگاهی برای این محصول نوشته نشده است.